The Headwinds Hitting The Renewable Energy Industry

OVERVIEW

As governments and businesses become more aware of climate change, there has been dramatic investments in renewable energy. However, the renewables sector is facing crosswinds.

With climate change being an increasingly urgent global issue, the pressure is on the renewable industry to plan and finance successful recoveries from catastrophic climate events. Yet building a framework of preparedness, having sufficient financial protection, and establishing it at scale before a disaster hits remain challenging.

How can the Asian renewable energy industry effectively manage these risks?

IN DEPTH

Whether you are talking a walk in New Delhi or looking at the Shanghai skyline from your office window, the skies have taken on a morbid shade of grey. For a while, the world had accepted this as the price of development. But now there’s widespread acceptance of the fact that a brighter and cleaner future is possible through increased awareness and adoption of renewable energy.

From batteries to biogas and power, Asia is driving the energy transition, accounting for nearly two-thirds of the worldwide increase in renewable energy generating capacity. China contributes a large share of this growth.

The country holds almost a third of all renewable energy patents and is also the world’s largest producer and exporter of solar panels, wind turbines, batteries and electric vehicles. The Belt and Road initiative has helped power China’s renewables sector greatly, giving businesses the opportunity to export clean-energy technology and take on large-scale electricity projects in emerging nations. In fact, China aims to increase their total share of solar and wind power to nearly 30 percent in 2030 from less than 10 percent in 2018.

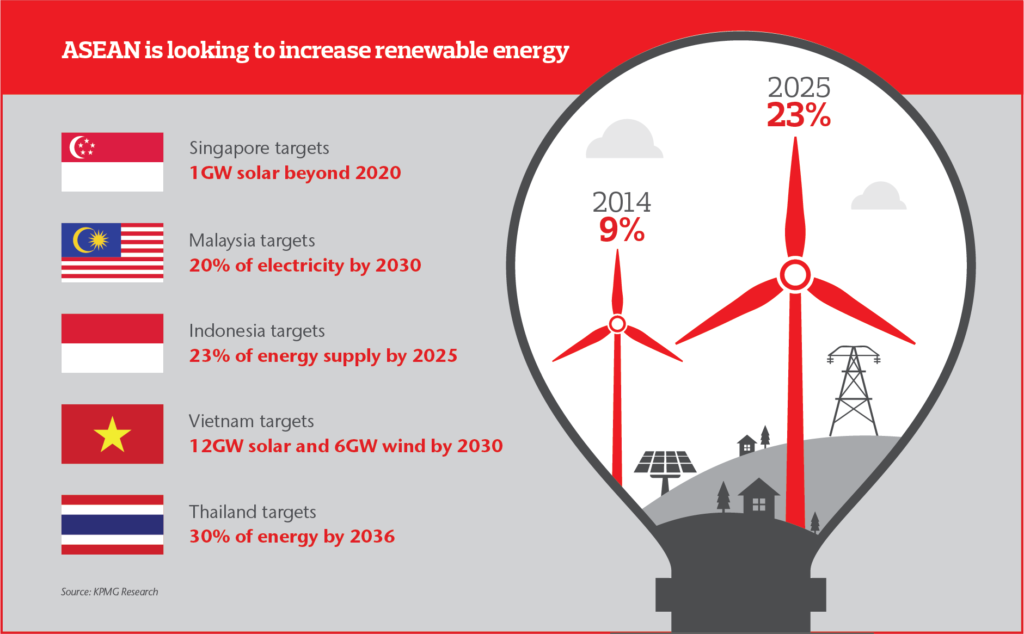

Vietnam too is pursuing a largely renewables-led plan. The country is the largest photovoltaic installer in Southeast Asia and an emerging market with attractive Feed-in-Tariff (FIT) for solar and wind energy, where households and businesses generating their own green electricity are rewarded, proportional to the amount of power generated. This gives more chances for international developers, contractors, and original equipment manufacturers to invest in the Vietnamese clean energy industry. At the same time, the nation’s electricity demand has increased at an average of 10 percent per year over the past five years. Despite its undeniable natural hydro endowments and lower-cost solar and wind power, Vietnam is also among those countries that are most vulnerable to climate change, according to a recent report by the International Panel on Climate Change. The country’s diverse geography means it is hit by typhoons, landslides, flooding and droughts – and weather events are expected to worsen in the coming years.

As extreme weather events continue to plague the region, renewable energy players will need to stay prepared and innovative to ensure the resilience necessary to recover from volatile climate risks.

Financing green investment

While governments across Asia have been providing subsidies and preferential policies to encourage growth in the renewable energy sector, most are now moving in the direction of promoting a level playing field when it comes to grid prices with traditional sources of power, such as coal. For example, China will end subsidies for new onshore wind power projects at the start of 2021, so that renewable projects can compete.

Large flows of finance are, and will continue to be, needed in order to accelerate renewable energy investments and progression. Private sources are bearing the burden of renewable energy investment globally, already providing 90 percent of investment worldwide in 2016, with conventional debt and equity being the most prominent financing instruments.

“As renewable energy assets become operational, utility companies, independent power producers, renewable energy developers, grid and distribution operators, and private equity and infrastructure groups across the energy industry will be looking for assets that can be aggregated in their portfolios, a key driver affecting future appetite”, says Tom Baker, director of commercial risk solutions, Asia, Aon.

Managing insurance gaps for resilience

In Asia, renewable energy projects come with certain challenges. First, there is a lack of a global standard for coverage, particularly for natural catastrophes. As the renewables industry is still relatively new, there are no business models that can guarantee profits.

“Therefore, insurers struggle to write coverage for green energy, leading to rising insurance costs,” says Baker. “Where coverage is available, stakeholders in the region lack understanding of their risk exposure and focus solely on pricing.”

Another key concern for the clean energy business in Asia is tied to its raison d’etre – climate change and natural catastrophes. “Renewable energy facilities often rely on natural elements, such as wind, solar, hydro, tidal and geothermal to operate. The volatility of these resources has led to Asia experiencing more billion-dollar natural disaster events in 2018 than anywhere else. This has also resulted in damages to renewable energy plants in the region. It is therefore prudent for energy sector stakeholders to evaluate the impact of natural disasters on their green projects and investments,” Baker adds.

Extreme weather events and climate change need a technological innovation response across the insurance industry, using automation, analytics, and AI to deal with a surge in demand for claim adjustments and ultimately deliver a better client experience when big weather catastrophes occur.

Prioritizing financial protection

While technology gallops, regulators and consumers are also calling for unprecedented levels of transparency. Business models are adapting, and new types of companies are entering the sector.

The challenge for renewable companies is making the right short- and long-term strategic choices when opportunities emerge. Assessment, management, and protection of projects using the appropriate insurance solutions and contractual risk transfer is becoming increasingly critical.

“Risk management discussions should be encouraged well before the onset of projects to ensure the appropriate risk allocations and insurance solutions are fully utilized,” Nicki Tilney, head of construction, power and infrastructure for Aon in Asia, advises.

Insurance can create a new frontier

Most insurers can adapt to changing weather patterns, but a greater strength of the insurance industry is in its long-term investment decisions and not just in the ability to underwrite risks. According to the Organisation for Economic Co-operation and Development (OECD), insurers, globally, are the second-largest institutional asset managers. Where and how insurers decide to invest those funds can change the game in mitigating catastrophe risk and launching what is essentially a transformative movement in resilience.