Intellectual Property: How Can Asia Protect Its Most Valuable Assets?

OVERVIEW

Today, something you cannot see or touch is likely to be more valuable than something you can. Just a decade ago, five of the top 10 companies in the world were oil companies, with PetroChina being the first to cross the $1-trillion mark in market value. Fast forward to 2019, technology companies have taken over – with the likes of Amazon, Apple, and Google, now leading the pack.

The value of intangible assets such as intellectual property (technology, patents, trademarks, copyrights) is increasing at a faster rate compared to that of tangible assets such as plant, property, and equipment (PPE). Intangible assets now account for significant revenues and are even backed by legal enforcement such as patent violation and litigation.

In 1975, over 80 percent of S&P 500 value was in tangible assets. By 2015, just a few short decades later, the reverse occurred: 84 percent of the value of the S&P 500 is now represented by intangible assets.

As IP can be a competitive differentiator, companies find themselves facing the persistent threat to their intellectual property. Almost half (48 percent of respondents) of companies surveyed by Aon and the Ponemon Institute in the 2019 Intangible Assets Financial Statement Impact Comparison Report have experienced a material or significantly disruptive security exploit or data breach one or more times in the past two years. Most incidents involved infringements of, or challenges to, the company’s IP (69 percent) or the company’s alleged infringement of third-party IP (31 percent). Also, most of these incidents involved trade secrets (42 percent), copyrights (26 percent) and patents (24 percent).

Despite these risks, and the greater potential loss, only 16 percent of information assets are covered by insurance – compared to 60 percent for physical assets. How can Asia be better-prepared to protect its IP?

IN DEPTH

The importance and use of intellectual property is rapidly expanding in Asia and so has a growing influence on business strategy. For instance, tech giant Alibaba has become China’s most valuable brand, having grown its brand value by 59 percent year-on-year to $141 billion in 2019. India’s global tech consultancy Tata Consultancy Services made it to the top 100 most valuable brands in the world, with a brand value of $14.3 billion. Generally, companies are now attributing 53 percent of their total value to their intangible information assets, according to the 2017 Cyber Risk Transfer Comparison Global Report.

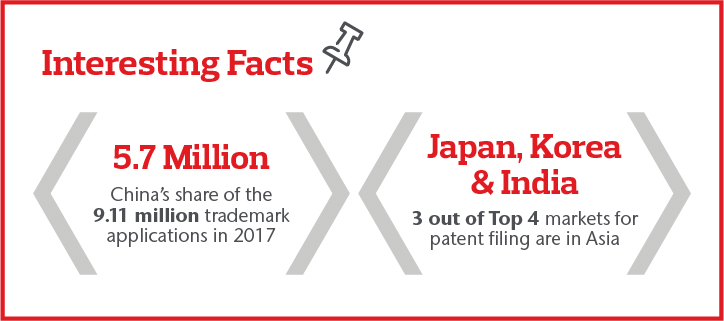

Alongside that, there were more than 3 million patent filings worldwide in 2017, a 5.8 percent growth from the previous year, according to Aon’s 2019 Asia Market Review. Nearly two-thirds of patent filings were made in Asia, with China at the forefront with more than double the number of patent filings than the U.S. What’s more, nine of the top 20 companies that filed patents with the United States Patent Office are Asia-based.

Loss of IP is a major business risk

The 2017 Cyber Risk Transfer Comparison Global Report found that the average potential loss if intangible assets are stolen or destroyed was 36 percent more than if PPE is damaged or destroyed. Yet, there is a major protection gap between intangible and tangible assets.

“Threats to a company’s intangible assets are not in proper balance with that company’s insurance protection,” says Murray Wood, Head of Financial Specialties, Asia, Aon. “Understanding how to properly value and insure intangible assets is exponentially heightened in the digital era. Intangible assets are a Board of Director level issue.”

Why is the loss of IP still so underinsured?

So, with such extensive media coverage about intellectual property litigations and cyber attacks, why is loss of IP still ranked so low?

According to Aon’s 2019 Global Risk Management Survey there are three possible explanations. First, IP is often overlooked because many small and medium-sized companies believe that it falls mostly within the purview of technology firms or multinational corporations.

Secondly, the value of intangible assets is still not fully understood across organizations, despite the fact that the number of cases and the amount of losses relating to intangible assets are growing and IP is the largest component, which now stands at $19.82 trillion in value (S&P market cap as at March 31st, 2018).

The third point is that the loss of IP has not traditionally fallen within the domain of risk management personnel. This is something that is fast changing but may account for the relative ranking given the profile of survey participants.

Protecting the intangible

Many businesses are beginning to recognize the value of intangible assets as well as the significant risks surrounding their loss.

The 2019 Aon and Ponemon Institute report found that there was a 33 percent increase in the protection of potential loss of information assets versus an increase of only 9 percent for PPE between 2015 and 2019. The report also found that there is increasingly significant interest in purchasing trade secret theft insurance policy and/or a patent infringement liability policy as a complement to a cyber risk policy. Currently, 24 percent of respondents say they have a trade secret theft insurance policy and a similar percentage of respondents (30 percent) have an intellectual property liability policy.

Wood says that while few companies have trade secret theft insurance policies or patent liability policies, organizations, by better understanding intangible versus tangible asset coverage, are better equipped to make informed decisions regarding strategy, valuation and risk transfer with respect to IP and other intangible assets.

“Across Asia, we expect the capacity and interest for intellectual property insurance to continue to increase as more companies will appreciate the value of their intangible assets,” Wood explains.

“We foresee a shift in mindset of companies becoming open to voluntary purchases of comprehensive IP insurance as a means of risk management beyond Warranty and Indemnity coverage, such as for tax insurance and cover for known litigation matters, IP insurance for intellectual property violations, and environmental insurance for pollution-related events,” Wood adds.