How To Address Emerging Pandemic Risk In The Philippines

OVERVIEW

Many Asian countries are seeing unprecedented pressures put on their health service infrastructure owing to the novel coronavirus (COVID-19) pandemic. The Philippines is facing extreme challenges due to the virus. As of September 2020, the Philippines has reported more than 241,987 cases and 3,916 deaths, according to data released by the country’s Department of Health. In addition to high infection rates and the day-to-day experience of living in the times of a pandemic, the country is under one of the world’s most prolonged and strictest lockdowns.

Since the Philippines observed its first cases of COVID-19, the government has tried to control the situation by imposing a multi-tier quarantine system. The strict lockdown measures have helped to suppress the transmission of the virus and eased some of the pressures on healthcare services. However, the Philippines remains cautious about reopening their economy and allowing citizens to return to their workplaces. A few essential businesses, such as business process outsourcing, manufacturing, retail, and food service have been allowed to operate as long as they follow the state-mandated measures on employee accommodations and screening protocols.

“Many of the state’s pandemic control measures have impacted both public policy and business regulations,” says Dr. Menandro Sandoval, medical director of health solutions, Aon Philippines.

“As a result, businesses face increased risk caused by significant revenue losses and associated cost-cutting measures. This is affecting both local and multinational businesses with a presence in the Philippines, all along the global supply chain.”

IN DEPTH

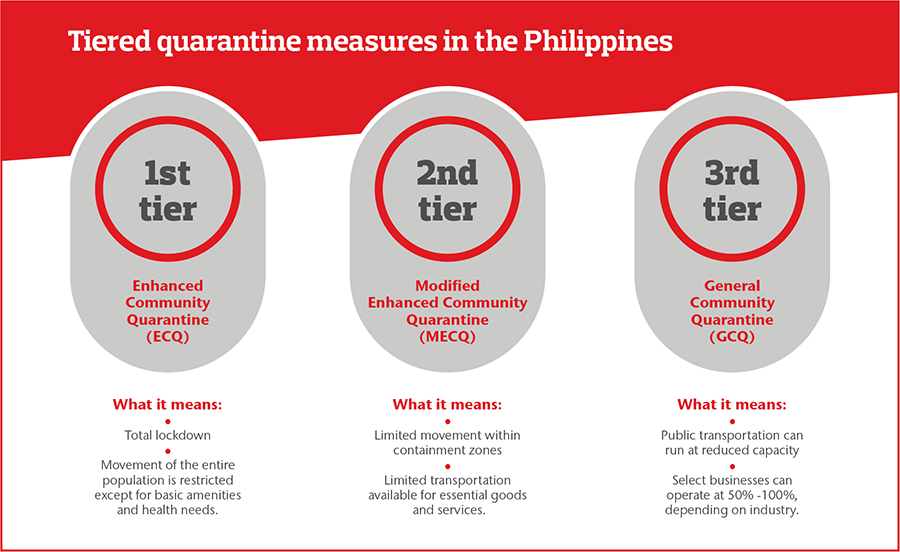

Since April 2020, the Philippines has seen tiered quarantine measures, depending on the severity of infection rates in a specific location.

The first tier of quarantine measures is Enhanced Community Quarantine (ECQ). This is the strictest measure and is implemented in areas with sharp spikes in infection rates. Effectively, ECQ is a total lockdown, restricting the movement of the entire population except for basic amenities and health needs.

The second tier is Modified Enhanced Community Quarantine (MECQ), which is less prohibitive. MECQ still limits movement within containment zones but with some transportation available for essential goods and services.

The third tier, General Community Quarantine (GCQ), allows public transport at reduced capacity and select businesses are permitted to operate at 50 percent to 100 percent capacity, depending on their industry.

The Emerging Impact on Businesses

These tiered quarantine measures have had a range of effects on essential healthcare services and business. As the economy has slowed, businesses have tried to stay afloat by cutting human resources costs, implementing temporary suspension of work and redundancies, sanctioned by the Philippines Department of Labor and Employment.

For their retained employees, organizations are now challenged by a potential rise in healthcare premiums, mainly due to the government’s health plan (PhilHealth) not covering typical inpatient hospital costs for serious COVID-19 patients.

However, these increases are likely to be more than offset. Health insurance benefits have seen significantly lesser utilization due to the lockdown delaying elective procedures, consumers avoiding hospitals in fear of COVID-19 infection, and hospital staff being reassigned to cope with the pandemic.

Claims data in the Philippines, from March to July 2020, show that aggregate monthly medical claims are 30 to 50 percent of normal levels in corresponding periods. “The COVID-19 pandemic has had an unusual effect on employer health plans in the Philippines – a status quo, or in some cases a decline in the rate of medical claims,” Todd Dore, vice president-actuary of health solutions, Aon Philippines explains.

This unusual dynamic means that the expected loss ratio for the current plan year − and potentially, the next plan year − is well below normal levels. There could well be a decrease in renewal rates for premiums next year, as the current impact of medical claims reductions continues throughout this year and into early 2021.

“This is likely to be good news for the insureds in the upcoming policy years. However, if the Philippines experiences more dramatic spikes in infection rates, there will be an impact on return-to-work policies, making business contingency plans that much more difficult to implement,” warns Dore.

Addressing Pandemic Business Challenges

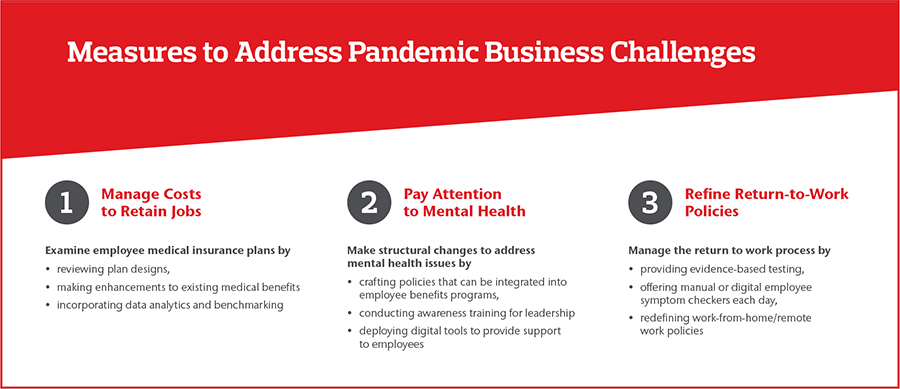

As businesses look to address the impact of the pandemic, the considerable uncertainties surrounding the crisis and its fast-changing nature can easily cloud leaders’ thinking about what is most important. It is critical that organizations focus on areas that have the greatest significance. Among other measures, business leaders can consider the following.

Manage Costs to Retain Jobs

By redefining roles and policies and creating a hybrid workforce with reduced working hours, businesses can adjust their compensation packages, medical benefits, and total rewards. Adjusting existing employee benefits packages to reflect the current situation will also help businesses save costs while retaining their best talent.

By redefining roles and policies and creating a hybrid workforce with reduced working hours, businesses can adjust their compensation packages, medical benefits, and total rewards. Adjusting existing employee benefits packages to reflect the current situation will also help businesses save costs while retaining their best talent.

Pay Attention to Mental Health

The Philippines has the highest depression rate in Southeast Asia, and mental illness is the third most common form of disability in the country. Dr. Menandro Sandoval, medical director of health solutions, Aon Philippines points out, “The Philippine government has released the Implementing Rules and Regulations (IRR) of the Mental Health Law just a month before the lockdown. This timely measure has kickstarted several compliance initiatives by businesses in the country.”

Employers are examining ways to offer mental health support to the workforce by making structural changes to their organizations to address mental health issues. These include crafting policies that can be integrated into employee benefits programs, conducting awareness training for leadership, and deploying digital tools to provide emotional, social, and financial support to employees.

Refine Return-to-Work Policies

Finally, when employees are permitted to return to work, organizations will need to closely manage the process. Measures such as providing evidence-based testing, offering manual or digital employee symptom checkers each day, and redefining work-from-home/remote work policies will ensure business continuity.

“Employers understand the positive impact of having a healthy and engaged workforce just as much as employees do,” explains Dr. Amitabh Deka, head of wellbeing solutions, South Asia and Aon Care. “The objective, however, must go beyond just managing the cost of the company medical plan. If you want to retain the basic shape of your organization with the view to win in a post-COVID-19 landscape, this will be an essential commercial characteristic and not just an altruistic one.”

Conclusion

“The months of lockdown in all major economies in Asia have led to new habits to form and existing behaviors to evolve. When the Philippines restarts its economy, businesses will need to have the right people to kick-start the recovery process,” says Dr. Sandoval.

Retaining the best employees, extending mental health support, and a well-planned return-to-work policy are longer-term investments that will help organizations avoid the aftermath of any knee-jerk responses to the immediate insecurities.