Asia’s Top Business Risk: How Can Risk Management Boost Competitiveness?

OVERVIEW

There’s no denying the strength of Asia’s economic power. Over the past 10 years, the gross domestic product (GDP) of the region’s emerging Asian economies expanded 160 percent, while global growth measured just about 30 percent. On top of that, a vast number of the world’s supply chains pass through Asia, with the region making up more than a third of the global contract logistics market.

A large part of Asia’s growth can be attributed to the rapid evolution of disruptive technologies and operating models, such as Industry 4.0 and the sharing economy, which will be worth $335 billion globally by 2025. Organizations that do not embrace new ideas and technologies face the risk of rapidly losing revenue and becoming obsolete.

While risk managers in Asia say their top risk is increasing competition, risk readiness levels have fallen to its lowest point in over a decade, according to the 2019 Aon Global Risk Management Survey (GRMS). How can organizations in Asia be prepared for today’s risks and tomorrow’s challenges?

IN DEPTH

Asia is a powerhouse for global trade, home to half of the world’s fastest growing companies, including China’s Tencent, South Korea’s LG, and India’s Tata Consultancy Services. However, in today’s level of unprecedented change, every organization, industry, and business leader has to confront more risks than ever before. Market uncertainty and competitive pressures such as global trade tensions, rising interest rates, and disruptive technologies such as blockchain, and artificial intelligence make the business leader’s job of managing volatility and maximizing performance much more difficult.

Risk readiness has declined

While business performance in Asia is still improving, risk appetite and maturity are not following suit, aggravating the risk of increasing competition in the region. Risk readiness levels show how prepared organizations are to address and manage risks and can serve as a barometer of risk management efforts. According to the 2019 Aon Global Risk Management Survey, risk readiness for increasing competition has dropped to 38 percent, down from 45 percent in 2017 and 49 percent in 2015. The Aon report found that this decline is linked to other broader trends such as digitization and fast-moving disruptive business models.

Despite the increasing interest in risk management over risk transfer – with the GRMS showing that while large companies generally have more formalized approaches to governance – the situation is less clear for smaller companies with turnovers under $1 billion. While these companies make up the majority of enterprises in Asia, only about 57 percent say they have a formal risk management/insurance department.

But there is a bright spot. “While companies of all sizes are struggling to prioritize their risk management efforts amid a changing and challenging commercial landscape, it’s heartening to see a growing trend of organizational reporting for risk management directly to the chief executive/president instead of to the finance department,” says Jane Drummond, Regional Head of Sales, Marketing and Aon Global Client Network, Asia, Aon. “This shows the growing importance of the risk management function in supporting growth and operational strategy.”

“With a rising number of industries focused on improving their risk management strategies, organizations could have access to tools and techniques to do a better job in improving preparedness, resilience and sustainability, and thus changing the emerging trend,” she adds.

How can organizations upgrade their risk management?

The global nature of today’s business means that several parts of an organization’s functions and divisions could be managing a particular risk at the same time. Such complexities mean that managing a particular risk cannot be done through a single business function or geography – a cross-functional approach to key risk management decisions is becoming increasingly crucial.

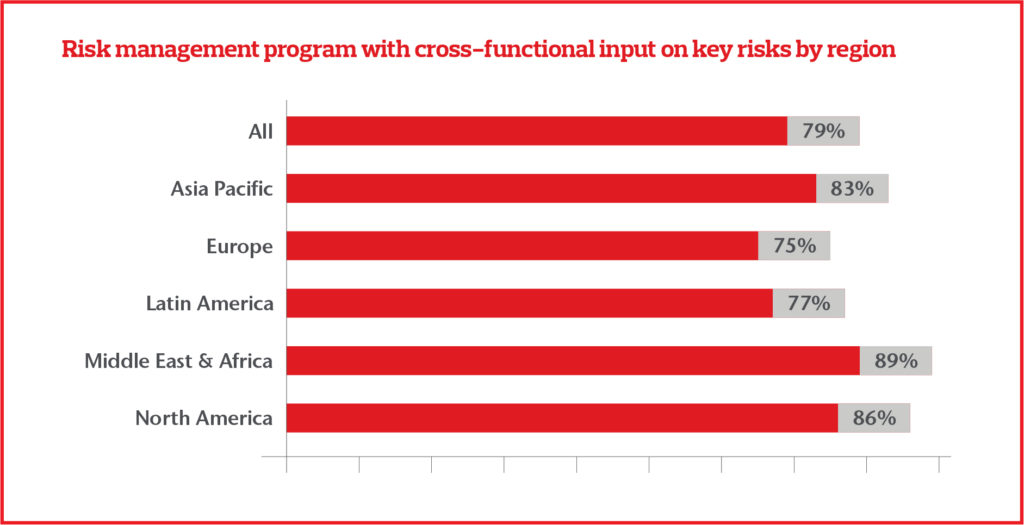

According to the 2019 Aon Global Risk Management Survey, there has been an 8 percent uplift in the number of organizations that engage in cross-functional collaboration in risk management. Regionally, a 16 percent increase in cross-functional collaboration – the largest recorded – was seen in the Middle East & Africa, followed by a 10 percent increase in Europe.

“In order to have a truly cross-functional approach, we believe that more organizations should incorporate all the listed departments in their decision-making process,” Drummond explains.

And there are signs that this is starting to happen: cross-departmental co-operation, especially with the corporate strategy function, has improved in the two years since the last GRMS. On top of that, as organizations tackle increasing cyber threats, for example, IT departments are beginning to come out of their silos.

As business leaders in Asia grapple with these risks amidst unprecedented change, Drummond highlights the need for the risk management function to become a company-wide priority, so that organizations are more prepared to overcome risks, protect their brand, serve clients, and stakeholders, and grow.

“As an organization evolves, so too must the entire risk management function,” says Drummond. “At the same time, risk managers must seek to expand their roles so that risk can be identified, assessed, and managed in an integrated way across the organization.”

The evolution of the risk management function to reach the enterprise level will help businesses protect their bottom lines while adapting to accelerated change and economic fluctuations.