Addressing The Political Challenges Of Asian Infrastructure

Overview

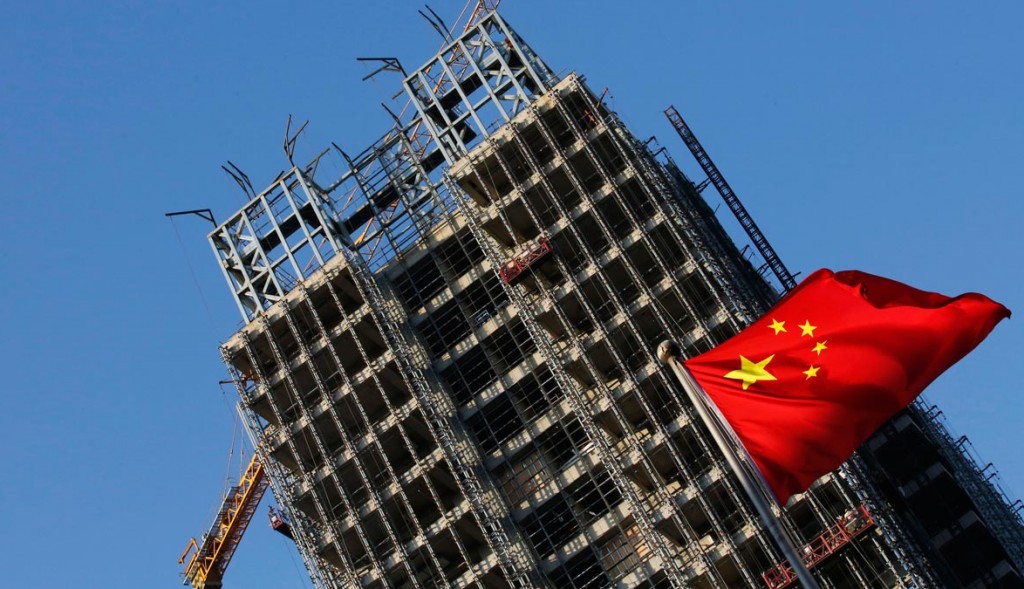

Economic growth, supported by huge flows of foreign capital, has expanded prosperity in many countries across the South and East Asian region, leading to declines both in poverty and political risk. But now, as China’s growth engine for the region subsides, regional competition for capital is likely to increase. While economic challenges in the short term create uncertainty, a renewed focus on anti-corruption efforts in the region could help states remain preferred destinations for foreign investment over the long-term.

The impact of anti-corruption campaigns in China, India, Indonesia and Malaysia are already being felt, according to the 2016 findings of Aon’s annual Political Risk Map. Across the Asia-Pacific region, tackling corrupt practices in both public and private sectors could not only reduce political risk, but also economic inefficiency. This in turn should support resilience in individual Asian economies at a time when emerging economies remain under intense pressure, helping them to more effectively address their growing infrastructure needs.

The challenge is very real. Urbanization and population growth is driving huge demand for basic essentials such as water, sanitation, transportation and electricity. This will place a clear focus on inclusive, sustainable development, that will reduce the already significant impact of development projects on the environment. At the same time, public financial resources are stretched and existing multilateral bank funding is insufficient.

New multi-lateral lenders, including the Asia Infrastructure Investment Bank (AIIB) may help to attract private investment to meet the region’s infrastructure needs. But ensuring this foreign capital remains for the long-term may also depend on progress in anti-corruption efforts. Clearer legal and regulatory frameworks and more transparent procurement structures could become important ways to accomplish both goals.

In Depth

Developing countries in Asia – including India, China, Indonesia, Malaysia, South Korea, Taiwan, Thailand and the Philippines – have achieved great success in generating prosperity, alleviating poverty, and encouraging political stability over the past 20 years. Much of this has been due to their ability to attract foreign investment through skilled labor, low wages, pro-market policies and political stability.

Political and economic risks in many Asian countries have also declined, as stable currencies, and in some countries the adoption of pro-market policies the spread of democracy have expanded prosperity and created middle classes. But now, the physical infrastructure that is needed to keep apace with the demands of growing and increasingly urbanized populations is proving inadequate to the task. Asia’s infrastructure market is set to grow to 60% of global demand by 2025, according to PwC’s Capital project and infrastructure spending: Outlook to 2025.

Balancing Reform, Growth and Uncertainty

Nevertheless, as the Political Risk Map reported, countries such as China may face uncertainties in economic policy as their governments try to strike a balance between implementing reform and managing growth. In China, President Xi Jinping continues to consolidate power through his anti-corruption campaign – the economic outcomes of which are likely to be positive – while in India, Indonesia and Malaysia measures to counter corruption are expected to improve political and economic resilience.

“Anti-corruption campaigns may rebalance concerns regarding a stalling Chinese economy, but improvements in political risk do not necessarily translate into economic gains,” says Karl Hennessy, President of Aon Broking and CEO of the Global Broking Centre in London.

“Macroeconomic drivers are behind the current slowdown in China,” Hennessy continues. “While a war on graft is likely to have a positive, long-term impact on China, it may also reflect efforts to stabilise an economy going through an unprecedented deceleration. Following stock market uncertainties earlier in the year and a slide in GDP, Beijing may be turning to additional levers to instil greater confidence in its future economic programme.”

The Rise Of Institutional And Private Funding

Outside of China, public funding resources for investing in this infrastructure are largely not up to the task. This is especially the case in poorer countries, where scarce government funding is needed to care for poor, largely rural populations. In countries such as India, this leaves little discretionary public funding available to support investments that would allow public infrastructure to keep pace with growing demands for better schools, healthcare facilities, care for the elderly, water, waste, electricity, broadband and other basic requirements.

As long-term investors in developed countries seek ways to diversify globally, opportunities to attract private investment from abroad to help meet this demand are increasing. However, competition for capital from other countries in the region also means that foreign investors will be weighing the relative risks more carefully than ever.

Existing multi-lateral lenders such as the Asia Development Bank (ADB) are inadequately funded to meet expanding demand for infrastructure, bureaucratic and slow. New multi-lateral lenders, such as the Asia Infrastructure Investment Bank (AIIB) and possible increased in capital flows from regional trade agreements like the Trans Pacific Partnership (TPP) may help to attract private investment to meet infrastructure needs.

The robustness of legal, regulatory and market structures are important factors for determining where this private capital will gravitate. But corruption, in addition being a drain on public finances, is a major risk factor for both public and private investors and is a key determinant in their choice of where to invest.

In China, where state-controlled enterprises, including infrastructure developers, absorb a huge proportion of the country’s financial resources, the government’s current anti-corruption drive is a central part of its goals to make the state more efficient, thereby freeing up capital in the more efficient private sector.

Some Asian countries, notably India, have significant Public-Private Partnership (P3) programs underway to help tackle their infrastructure needs. When they work well, the competitive bidding and need for transparency involved in P3 tendering can itself help to reduce or eliminate corrupt influences. At the same time, the contract forces greater accountability on to the private sector by specifying penalties for inadequate delivery or maintenance of the asset.

Partnership structures such as these can also bring stability to foreign investment flows into the country, create local jobs, encourage the development of a domestic investor base and even respect for the rule of law. At the same time, foreign institutional investors gain investment and currency diversification and the potential to earn strong returns on investment.

For Asian economies to overcome the potential ripple effect of China’s current economic slowdown and secure sustainable long-term growth, increasing political stability can play a key part. While much progress has been made in recent years, as seen in the findings of Aon’s Political Risk Map, there is still work to be done – and political stability is only part of the story.

Talking Points

“Southeast Asia is home to some of the richest, fastest-growing economies, as well as some of the planet’s poorest people. Battling corruption is an integral part to sustainable growth and reducing income inequality. Regional cooperation coupled with civil society and business community involvement… are essential elements to ensure… a positive impact on the daily lives of Southeast Asians.” – Natalia Soebagjo, Chair of Transparency International Indonesia

“There are so many good reasons why companies and shareholders would bribe to make sure a listing went through. That seems to have been accepted practice with minimal clampdown…. That will continue as long as you have this approval process. This is a clear example where the process is ultimately leading to the malfeasance.” Fraser Howie, co-author of three books on China’s financial system

“The Communist Party central leadership’s firm determination to fight corruption has not changed; the goal of preventing corruption from spreading has not changed,” Chinese President Xi Jinping

“Governments should minimize risks for private investors by addressing policy, institutional and regulatory barriers to investment. They should fix governance problems, implement transparent procurement systems, and establish viability funding gap mechanisms to mobilize public funding for investments that private sector firms cannot undertake.” – Bambang Susantono, Vice President, Knowledge Management and Sustainable Development, Asian Development Bank

Further Reading

- Graft a ‘malicious tumor hurting China’s economy’ – The Straits Times, March 8, 2016

- Modernization Drive Could Cast Shadow On Asia-Pacific – Nikkei Asian Review, January 10, 2016

- The Anatomy of Anti-Corruption – Geopolitical Weekly, October 27, 2015

- How Do Companies With Asian Operations Navigate Bribery and Corruption Risk? – Kroll, September 25, 2015

- Survey Finds South-East Asia Still Struggling With Corruption – The Business Times, January 27, 2016

- Asia’s Era of Infrastructure – World Economic Forum, January 23, 2016

- Infrastructure Investment, Private Finance, And Institutional Investors: Asia From A Global Perspective – Asian Development Bank, January 2016

- Political Risk Map 2016 – Aon report

- Asia Market Review 2016 – Aon report